Digitizing Supply and Demand ⚡️

Watching the explosive growth and global adoption of Uber and Airbnb has convinced me that strangers are willing to connect for the right price. These platforms digitize supply and demand, creating wealth not only for the company shareholders but also for the suppliers using the site. Flexible, asset-light business models have the potential to disrupt incumbents, which rely on pre-Internet distribution methods and extensive inventories. In this new game, fleets of taxis or hotel chains have become liabilities rather than assets during the growth phase. Peer-to-peer exchanges allow new companies to avoid buying inventory; instead of managing physical goods, the company exists to create a service that unlocks the value of assets that users already own.

So, what’s next? Consider a graph with two axes: Utilization and Cost. Utilization is how frequently the owner of the good can derive economic benefit from their ownership (e.g., sleeping in the house they own or driving the car they bought). Cost is the purchase price of the good. The worst place you can be is the top left: you paid a lot and rarely used it.

Homes fall in the top right corner of this spectrum: they are usually the most expensive physical object a person owns, but are used for the better part of each day. Vehicles are a bit murkier. They are relatively expensive, but even the heaviest commuter will spend less than 25% of the day in their car.

For rational consumers, a purchase falling high on the Cost axis must also be sufficiently far to the right. This is known as “getting your money’s worth.” In the U.S., we have accepted that we are getting the raw end of the deal for automobiles, simply because we've designed so many essential functions around auto ownership. Owning a car is factored into the cost of living.

Services like Airbnb and Uber allow suppliers to take advantage of untapped utilization to make money from their assets. They flip the axis so that available utilization becomes a measure of supply — a positive trait.

The opportunity appears for suppliers when the area under the curve is larger than the cost of ownership. Uber provides a way to fill the extra 10 hours in a day when your car would otherwise be sitting (a number that will increase when autonomy becomes widespread). Airbnb is playing with thinner utilization, but the value of a home for the night is much higher.

However, unlocking supply isn’t enough: to create an active marketplace, there must also be a significant need. The size of the total addressable market is related to the generalization of the good being offered. The demand just isn’t there for your incredibly rare yet expensive collection of Asian manga novels, yet housing and transportation offer a utility for millions. These types of goods are able to command a premium due to the high cost of the underlying asset driving the value of the service being offered. As we continue to explore these types of business models, the next logical step is to move down the “Cost” stack. New opportunities appear when we remove the constraint of a minimum transaction value. Improvements in software development and consumer expectations have evolved since the inception of the sharing economy over a decade ago, helping to shape the path for new entrants. Companies taking advantage of this opportunity will see lower average transaction values, but will benefit from the knowledge of how to deliver the service cheaply and reliably.

Uber went public earlier this year and is currently trading at a market capitalization of $73B. The U.S. ride-sharing market has eclipsed $100B and is still growing. Airbnb is worth north of $30B and operates in more than 60,000 cities. Moving downstream means a smaller market, but at this scale even an organization 1/10 the size can command the coveted unicorn valuation.

As software continues to eat the world, there is no question that we will see everything from fashion to electronics become available on demand. The real question is: who will build it?

📚 Reading

Elementary school students who live downwind from a pollution source experience lower test scores. Link.

A report from Harvard School of Engineering and Applied Sciences (SEAS) on how to make Mars hospitable. It involves spreading a thin layer of aerogel over a large area of the planet to increase surface temperature. Link.

10,000+ word Wait But Why cover story on Neuralink from 2017. Link.

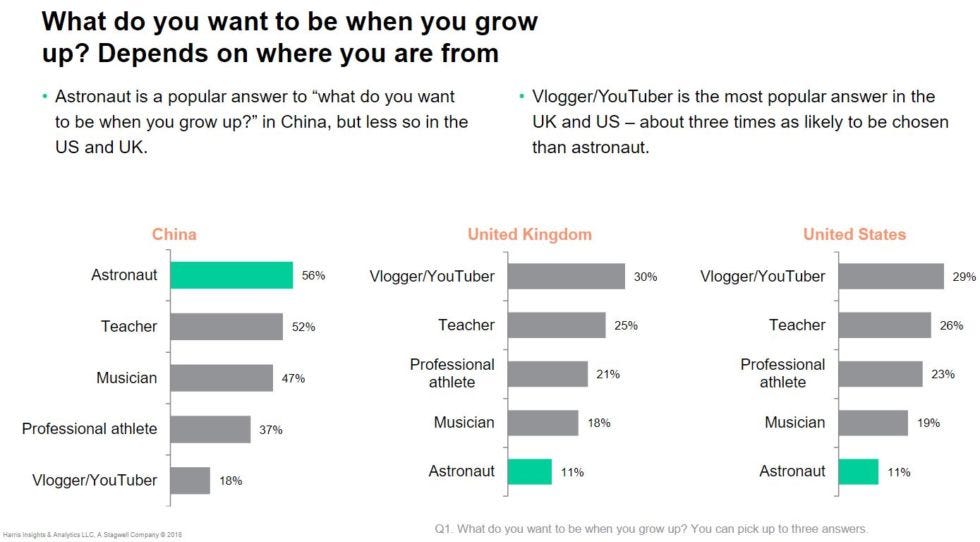

American and British children want to be rockstars. Chinese students want to be astronauts. Link.

SpaceX broke records this year for the largest number of satellites approved via their Starlink program. As the amount of space debris increases, countries will need to overhaul the international law that governs the area outside of our planet. Interesting read from the Economist on the history of space law. Link.

David Marcus (VP at Facebook leading the Calibra wallet) spoke before Congress this week about their plans to roll-out a global cryptocurrency. Many of the questions were crypto-related, but the sense is that the Libra project is becoming a catch-all for privacy criticisms and the ongoing reach of Big Tech. Highly recommend watching: David is a consummate professional and seasoned executive. Consider this a 101 on how to discuss controversial topics with Congress. Link.

💎 Quote of the Week

Later on in life, the Tralfamadorians would advise Billy to concentrate on the happy moments of his life, and to ignore the unhappy ones -- to stare only at pretty things as eternity failed to go by.

So it goes. Kurt Vonnegut’s exploration of the passage of time and cavalier attitude about death is one of the reasons that I’m including this line from Slaughterhouse Five in my list of favorite quotes. Sometimes we need a reminder to stare at the pretty things.

Have an idea for a future topic? Send me an email at newsletter@philmohun.com

Follow me on Twitter and Medium.

Not a subscriber yet?